Recurring billing is more than just a tool for SaaS and tech startups; it’s the key to sustainable revenue. When done right, it makes cash flow more predictable, reduces customer churn, and builds trust. But adding recurring billing to your current tech stack can be hard. It’s not enough to just automate invoices; you also have to manage disputes, get back payments that didn’t go through, keep track of how customers behave, make sure everyone follows the rules, and keep the user experience smooth.

We at Progressarc.io are experts in offshore software development and managed recurring billing. We know from experience that a bad billing setup can stop a growing business in its tracks, while the right infrastructure can help it grow with confidence. This blog will show you a better way to set up recurring billing using internal SOPs and real-world examples. It won’t break your system or your business.

Why Recurring Billing Integration Is Mission-Critical

A lot of new businesses don’t know how hard it is to set up automatic payments. It may seem easy to charge customers every month, but the processes behind it—making invoices, retrying payments, dealing with declined transactions, settling disputes, and keeping track of revenue—can quickly become a mess if they aren’t organized. When startups make billing solutions without a plan, they often end up with data silos, manual workarounds, and unhappy customers.

Our internal records show that unresolved billing issues are one of the main reasons accounts are deactivated and revenue is lost. Customers are much more likely to leave if there isn’t a strong system in place to handle billing issues. This means the business has to spend more time fixing things. In simple terms, billing isn’t just something that happens in the back office. It’s a key point of contact with customers and the heart of the business.

Why Recurring Billing Is More Than Just Charging Cards

A lot of people think that “recurring billing” just means setting up automatic payments and then forgetting about them. But the truth is that recurring billing is what keeps your income steady, and it’s one of the first things that goes wrong as you grow if you don’t handle it right.

Recurring billing is a complicated system that affects almost every part of your business, including finances, customer service, product delivery, and compliance. It does a lot more than just send bills or swipe cards every month.

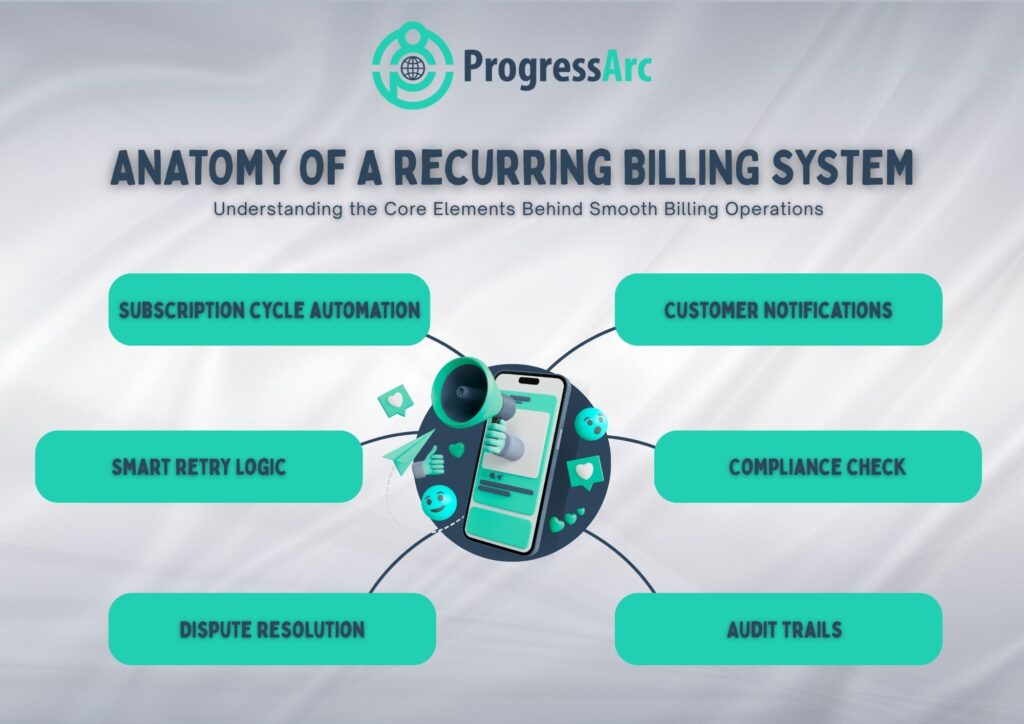

Here’s what a well-structured recurring billing system handles:

- Automating subscription cycles so that billing runs like clockwork, without manual involvement.

- Managing failed transactions and disputes with smart retry logic and fast resolutions.

- Maintaining detailed audit trails to ensure accurate financial records.

- Keeping customer satisfaction high by resolving payment issues without friction.

- Ensuring financial compliance with regulations like PCI-DSS, ACH guidelines, and data privacy laws.

- Preventing revenue leakage by catching missed payments before they spiral into churn.

But what happens when it’s not done right?

You don’t just lose money—you lose time, trust, and momentum.

Without a carefully integrated system, you open the door to:

- Broken workflows during payment retries that frustrate both your team and your customers.

- Disjointed follow-ups that let overdue invoices slip through the cracks.

- Manual invoicing errors delay payment and reduce credibility.

- Compliance failures that can trigger penalties or payment suspensions.

- Inaccurate financial reporting makes it hard to plan, forecast, or even close your books on time.

Real Insight: At ProgressArc, our internal procedures show that one of the main reasons accounts are deactivated is because of payment problems that haven’t been fixed. And when things go really wrong, they end up with third-party collection agencies, which causes stress, hurts relationships, and hurts your brand’s reputation.

2. What a Smooth Recurring Billing Workflow Actually Looks Like

At ProgressArc, we think that regular billing should be simple, smart, and completely in line with your company’s requirements rather than a hassle. In addition to sending out invoices, a genuinely seamless billing system provides a consistent, tailored experience that fosters enduring client loyalty. And our teams consistently deliver just that.

Our offshore billing specialists adhere to a framework intended to maximize revenue collection while improving customer satisfaction thanks to their in-depth industry knowledge and meticulously planned procedures. This is how it operates:

A. Invoice Generation

- Invoices are automatically generated on the first of every month.

- Invoices are sent to partners on the fifth.

- Independence from the first to the fifteenth is made possible by custom preferences, which guarantee that billing meets customer needs.

- Prior to billing, subscription plans are examined to account for any service modifications, upgrades, or cancellations.

At ProgressArc, we recognize that giving customers the ability to customize their billing preferences gives them a sense of control, which in turn fosters enduring loyalty.

B. Payment Processing

We also manually monitor every transaction to make sure no information is missed and to guarantee total accuracy and transparency. By using both automation and human oversight, we can avoid late payments and keep accurate, up-to-date billing records.

We view payment processing as an essential component of the customer experience rather than merely a backend function. Customers trust your system when the process runs smoothly. Loyalty is fueled by that trust. Additionally, ProgressArc is better able to anticipate and surpass the expectations of our customers when there is a high level of loyalty.

We at ProgressArc make the payment process dependable and simple. When an invoice is sent, the customer’s preferred payment method is used to initiate autopay.

- Using pre-selected payment methods (Visa, Mastercard, ACH, etc.), auto-pay begins.

- Automatically, unsuccessful attempts are retried over a period of days.

- Manual exceptions are tracked and recorded, but they are not recommended in the long run.

C. Follow-Up System

At ProgressArc, we prioritize understanding our clients’ subscription-related problems in addition to providing a seamless customer experience. We can better understand their problems by following up with them on a regular basis. This helps us match our services to their needs and expectations for smooth recurring billing.

Our system makes it simple for customers to fix problems without difficulty by sending out friendly email alerts with secure payment links as soon as a transaction fails.

- Friendly email alerts with payment links are sent out when transactions fail.

- Via SMS, phone calls, and emails, rejections or disagreements are escalated.

- A well-organized weekly plan guarantees regular follow-ups, which lowers the possibility of revenue loss.

Best Practices to Integrate Recurring Billing Seamlessly

A. Choose the Right Billing Platform

Your billing system should do more than just take payments; it should also help people trust you. Charge Over and other tools work perfectly with your CRM and support platforms. They let you create custom invoices, set up smart retry workflows, and see everything in real time on dashboards. You can also stay ahead of the game by automatically tracking payment methods that are about to expire. This will cut down on problems and make customers happier. Your customers stay confident and connected when billing goes smoothly.

B. Establish a Defined SOP for Billing Events

We at ProgressArc think that being clear builds trust. That’s why we give each client a clear billing SOP, so they never have to wonder what to do. Our playbooks are made to keep things simple, fair, and clear. They tell you when to void an invoice, how to choose between a refund or credit, and when account deactivation alerts will be sent.

This structure not only cuts down on mistakes, but it also makes your customers feel better, makes things easier, and builds long-term loyalty through trust and consistency.

6. Let Offshore Teams Handle Billing Integration and Optimization

The people who work behind the scenes at Progressarc.io are your offshore billing experts. We take care of the whole Charge process. Over setup, connect with your CRM, like HubSpot, so that follow-ups go smoothly. Also, run real-time Slack escalations so that nothing gets missed. With Google Sheets dashboards, you can keep track of your receivables every day, week, and month, making sure that everything is clear at every step. We handle everything from recurring invoice logic to managing disputes and updating accounts. This makes your billing easy, stress-free, and ready to grow.

8. Compliance and Security Must Be Baked In

Trust is the most important thing in recurring billing. That’s why ProgressArc makes sure that every part of your billing system is safe and follows the rules. Our processes follow all the rules for PCI-DSS, which means they can safely store cards. They also use tokenization to make sure retries are safe, and they are smart enough to stop failed attempts on disputed cards. We also follow all local and global banking rules to make sure your business is safe.

Can you give me a real-life example? Some banks only let you make recurring payments on certain days. Our SOP catches that ahead of time, so you never miss a payment or lose a client’s trust.

9. Data Visibility & Analytics Are Non-Negotiable

You can’t fix something if you can’t see it.

We at ProgressArc think that billing data should do more than just sit in a spreadsheet; it should help you make smart choices. Our dashboards and custom Google Sheets, which are based on SOPs, keep track of everything from overdue invoices and customer usage to follow-up progress and risks of deactivation. In real time, you’ll know exactly who is behind, who isn’t working, who needs a payment plan, and who needs help right away.

This isn’t just billing; it’s your front-line operational intelligence, which is meant to protect revenue and improve customer relationships.

10. How to Scale Recurring Billing Without Breaking Your System

Your billing system needs to grow along with your customer base, but it shouldn’t break your backend. We at ProgressArc suggest smart ways to do things like separating billing logic into microservices, not using hard-coded plans with real-time API pricing, and making billing health reports to keep track of retries and dispute trends. Using different gateways, like Stripe or Authorize.net, can help make sure that payments go through all over the world.

As you grow, you’ll encounter more billing issues. Unless you have automation, monitoring, and a smart structure that can grow with you.

Conclusion: Build It to Last, Not to Patch

It’s not a feature; it’s a system for recurring billing. It needs to work perfectly with accounting, product, finance, customer success, and support.

It breaks your revenue flow when it is not integrated well. But if you do it right—with automation, real-time tracking, smart SOPs, and experienced offshore teams, you can count on it, scale it, and earn your customers’ trust.

With Progressarc.io’s offshore and managed billing services, you can build a strong recurring billing system from the start without going over your budget or breaking your stack.

Do you need a billing health audit or help setting up Charge Over, HubSpot sync, or a custom follow-up process?

Let Progressarc.io take care of your recurring billing so you can focus on growing your business.