Running a startup can feel like you’re walking a tightrope because you have to do so many things at once. It is easy to feel overwhelmed by the amount of work involved in developing your product and providing customer service. Between tracking subscriptions, sending invoices, and dealing with payment failures, it can drain your energy and hurt your cash flow. That’s where having the right tools and expertise comes in.

In this blog, we’ll walk you through how to choose the best recurring billing system for your startup, the features you need to look for, and how ProgressArc’s offshore remote experts can seamlessly integrate into your business, handle the technical nitty-gritty, and monitor your subscription billing like pros.

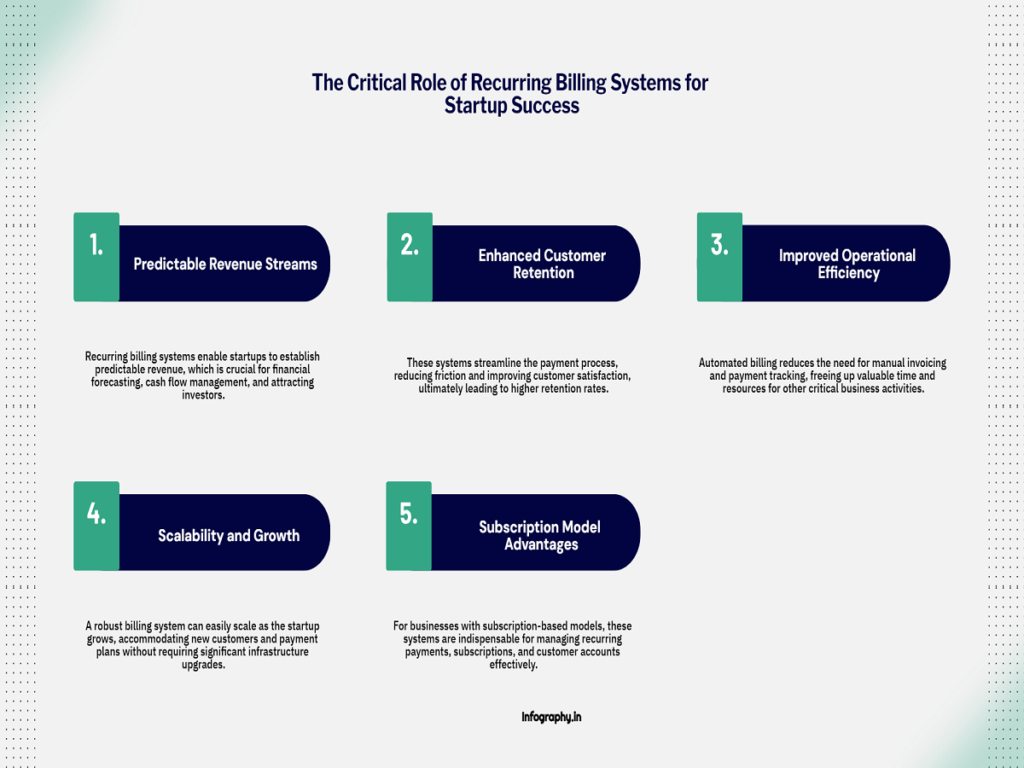

Why the Right Recurring Billing System Matters for Your Startup

Recurring billing isn’t just about shooting out an invoice every month; it’s also a great way to keep money coming in and establish credibility with your clients. The right billing system makes sure you get paid on time, every time, without any headaches. For startups, nailing down an efficient recurring billing setup could be the difference between thriving and crashing. A subscription-based business requires a payment processing system that can keep tabs on payments, handle them efficiently, and provide clients with options. Such flexibility will be appreciated by clients.

Now, picking the right system? Yeah, that can feel a little overwhelming, but that’s where ProgressArc steps in to save the day. We’re not here to hand you another piece of software to figure out, but we’ve got something better for you. ProgressArc connects you with offshore remote pros who seriously know their stuff when it comes to recurring billing systems. Our team plugs right into your setup, handles all the billing chaos, and makes sure everything runs like a well-oiled machine. You won’t even have to lift a finger because our professionals will handle billing, integrate with your current infrastructure, and make sure everything goes well.

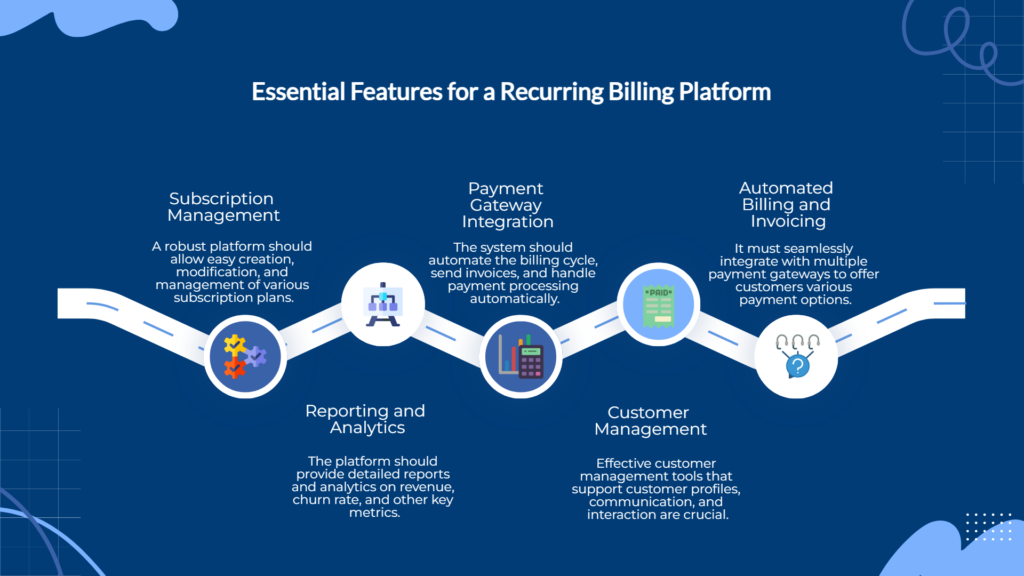

Key Features to Look for in a Recurring Billing System

Let’s talk about what really makes a recurring billing system a game-changer for your startup. Here is a quick recipe to automate payments or keep customers longer. These features should be in your checklist:

1. Automated Billing and Invoicing

The last thing you want to worry about is manually generating invoices. Automated billing means that the system generates and sends invoices automatically at regular intervals, reducing human error and improving accuracy. Every invoice complies with the subscription conditions that were decided upon with the client. The majority of invoices are sent on the first of every month, but for clients with particular billing requirements, invoices may be sent on other dates, and payment is due at the time of receipt. The system verifies every subscription before sending it to ensure that any requested modifications, such as additions, deletions, or cancellations, are handled appropriately. To prevent errors, cancellation notes are also checked in accordance with decisions made at Churn meetings.

When ProgressArc’s authorized remote recurring billing professionals handle the setup and ongoing subscription management, your billing process stays accurate, on time, and easy.

2. Subscription Management and Tracking

Subscription management involves how customers can track and manage their subscribed services. Customer new sign-ups, renewals, cancellations, and changes made in the middle of a cycle, such as upgrades, downgrades, or add-ons, are all part of subscription management. Sometimes, some customers might even have more than one active subscription on the same account.

It should be easy to manage all these changes with a solid recurring billing system. With ProgressArc’s authorized remote billing experts, all customer requests are instantly processed, ensuring service accuracy with zero downtime.

We also help set up tiered pricing, custom subscription bundles, and usage tracking so that each customer has a unique and smooth experience.

3. Payment Collection and Processing

One of the most important tasks of a recurring billing system is to securely collect and process payments. The system should be able to handle more than one payment method and let people try to pay again if a transaction fails. With the help of ProgressArc’s remote experts, we’ll help you pick the payment processing platform that works best with your recurring billing software. Our outsourced recurring billing experts will make sure that every transaction goes smoothly and safely.

4. Failed Payment Management and Retry Logic

Let’s be real, sometimes payments fail. A solid recurring billing system will automatically handle these failed transactions by retrying and notifying customers to update their payment information. This reduces the time and effort you need to spend following up.

5. Flexible Billing Cycles

Not every customer follows the same payment plan. Month-to-month or yearly payments may be preferred by some. You may adjust billing cycles to your customers’ preferences with a good billing system. ProgressArc’s remote specialists will make sure that your system’s adaptability satisfies your demands, regardless of whether you’re providing pay-as-you-go models or subscription-based services.

6. Integration with Accounting and Other Tools

You want your billing system to play well with your accounting software, CRM, and other tools you use. ProgressArc’s remote recurring billing experts can help new businesses and startups set up these tools so they work together perfectly. This will save you time on entering data by hand and make sure your reports are always up to date.

7. Comprehensive Reporting and Analytics

Knowing how your subscriptions are performing is key to running a profitable business. A recurring billing system should provide reporting on customer retention, revenue trends, and failed payments. ProgressArc’s offshore experts are experienced in setting up and monitoring analytics, so you can stay on top of your finances without worrying about the tech side.

Affordable Recurring Billing Tools for Startups

Running a startup means you need tools that are effective, affordable, and scalable. There’s no need to overspend on billing systems when you can find the right fit for your budget. Here are some of the best tools you can consider:

1. Helcim – The Small Business Bestie

Helcim is perfect for small businesses. There are no hidden fees, and it’s easy to understand. You can make your own billing cycles, automatically retry payments that didn’t go through, and add subscription add-ons to sell more. Helcim is a great choice for new businesses that want to keep things simple.

What’s Great About Helcim:

- Custom billing cycles

- Simple subscription management

- Low transaction fees

With ProgressArc’s remote developers, seamless integration is no longer a problem. Adding Helcim to your current business systems is as easy as getting your money. Hire ProgressArc remote offshore developers to make it easy and quick to process payments.

2. Stripe – The Developer’s Playground

Stripe is the techie’s go-to, offering tons of customization options through APIs. Stripe is one of the best options for businesses that need flexibility and the ability to grow. You can set up complicated billing processes, take payments from all over the world, and even give your customers different price levels.

What’s Great About Stripe:

- Flexible, customizable payment options

- Supports multiple currencies

- Ideal for SaaS and global businesses

With ProgressArc’s experts on your team, you can implement Stripe without worrying about the technical side. Our remote experts will ensure seamless integration with your website or app and ongoing monitoring to ensure everything stays on track.

3. Chargeover – The Simple Starter

ChargeOver is designed for growing businesses and is intended to simplify subscription billing without compromising flexibility. Chargeover takes the load off by automating time-consuming billing operations while giving a frictionless vibe for your users. With Chargeover, you can manage one-time payments, roll out discounts, and set up a monthly subscription.

Plus, your customers can sign up for subscriptions or buy things through a secure, hosted sign-up form without needing to know how to code.

What’s Great About Chargeover:

- Secure hosted sign-up forms that you can change, and pages with your brand on them

- Choose from flat-rate, volume-based, tiered, or bundled pricing options.

- Tailor emails, invoices, branding, and user roles to match your brand identity.

- Seamlessly integrate with your app and other systems using REST API and webhooks.

- Create custom plans, set your own pricing, and run targeted promotions effortlessly.

- Let customers manage their own subscriptions via a no-code Billing Portal.

- Automate pricing changes and delayed payments.

- Automating coupon codes, discounts, and late fees

- Support for multiple products, currencies, and customers

- Strong analytics for MRR, churn, taxes, and other things

You can easily set up and manage Chargeover with the help of ProgressArc’s offshore billing experts. ProgressArc’s remote offshore developers can make sure that it works with your other products and that your subscription billing continues to function properly as you grow.

4. Recurly – The Subscription Management Specialist

Recurly is made for businesses that rely on subscriptions a lot. Recurly is great for startups that want to grow their subscription models because it has advanced tools for managing multiple subscription tiers, billing based on usage, and even getting money back.

What’s Great About Recurly:

- Advanced subscription management

- Automated revenue recovery

- Purposeful analytics and reporting

ProgressArc’s outsourced developer can help you get the most out of Recurly, so you can grow without any problems.

5. Chargebee – The Enterprise Powerhouse

Chargebee is a more complex option for startups that are growing fast and need a system that can handle a large volume of recurring transactions. It has a lot of automation options, works with multiple currencies , and follows all the rules for taxes around the world. This makes it perfect for businesses that want to grow into new markets.

What’s Great About Chargebee:

- Robust automation features

- Multi-currency and global tax compliance

- Scalable for growth

Chargebee can be tricky to set up without technical expertise, but that’s where ProgressArc’s offshore remote resources come in. Our experts can implement Chargebee within your system, ensuring you get the most out of its advanced features.

Real Case Study: How ProgressArc’s Experts Helped a SaaS Startup

Case Study: CloudTech Solutions

CloudTech Solutions, a SaaS startup, was struggling to manage recurring billing manually. They had over 200 customers and were dealing with payment failures, delayed invoices, and customer complaints. They decided to work with ProgressArc’s offshore remote developers to integrate a recurring billing system.

We recommended Stripe for its flexibility and global capabilities. ProgressArc’s team handled the integration, set up automated billing and payment retries, and created custom workflows for subscription management. Within three months, CloudTech saw a 15% improvement in cash flow and a 25% reduction in customer churn.

The key takeaway? With the right recurring billing system and the help of ProgressArc’s experts, CloudTech Solutions was able to scale their operations without the constant headache of manual billing.

Choosing the Best Recurring Billing System for Your Startup

There are many choices when it comes to picking the best recurring billing system for your new business. The most important thing is to know what your business needs. Do you need a simple fix or a more powerful one? Are you going to grow your business internationally, or will you mostly serve a local market? With ProgressArc, you don’t have to make this decision alone. Our offshore remote experts specialize in integrating recurring billing systems into your existing infrastructure and monitoring them to ensure smooth operations. We can also advise on the best platform for your needs and scale the system as your business grows.

Conclusion

Having the right recurring billing system can save you time, cut down on mistakes, and help your cash flow, but only if you have the right one. You need tools that are flexible, cheap, and can grow with your business as it gets bigger.ProgressArc’s remote offshore experts can help you integrate, monitor, and optimize your subscription billing system so that you can focus on what you do best: growing your business.

Wanted to make your recurring billing easier and help your business grow? Let ProgressArc’s remote experts take care of the technical details so you can focus on the scalable growth of your business. We offer cost-effective offshore recurring billing services, whether you’re setting up your first system or improving one you already have. Visit our website at progressarc.io and schedule a consultation to scale your team with our skilled remote professionals.