For thriving startups, speed, efficiency, and cash flow are the ultimate currency. Every dollar spent and payment received has an effect on the runway and the ability of a company to grow and come up with new ideas. A lot of time and money can be wasted by tech companies, especially those that offer software as a service (SaaS), trying to figure out how to handle recurring billing. This is where offshore recurring billing comes in as a game-changer. Startups can lower their operational costs and speed up their payment cycles by using expert billing teams that can be operated from anywhere. This will eventually change their financial health.

For thriving startups in the USA, speed, efficiency, and cash flow are the ultimate currency… Offshore recurring billing comes in as a game-changer. With remote recurring billing services and account receivable management services USA, startups can lower costs and speed up payment cycles

The Startup Billing Dilemma: Why Traditional Methods Fall Short

The subscription model is a terrific thing. It offers a steady flow of income, which is important for planning ahead and getting investors. But running it is not at all easy. As a startup grows, it can quickly become a full-time job to handle the bills But when comparing annual billing vs recurring billing, startups quickly realize manual methods fall short.

The worst thing that can happen to a business is manual billing. Time spent creating and delivering bills, pursuing past-due payments, and maintaining account balances could be better used to produce or market goods. This results in:

- Delayed Payments and Cash Flow Issues: Payment times increase with the length of time it takes to send an invoice. This has a knock-on impact that makes it hard to fulfill operating expenses and results in irregular cash flow.

- High Administrative Costs: A new business can’t afford to hire an in-house billing specialist because it’s kind of a luxury. A new business can’t afford significant expenses in terms of salary, benefits, and overhead that add up quickly.

- Increased Errors and Revenue Leakage: People make mistakes when they enter data by hand, which can lead to wrong bills, undercharging customers, or not collecting money from usage-based plans. This “revenue leakage” can hurt profits without anyone noticing.

- Stagnant Scalability: As a company grows, so does the amount of billing that needs to be done. A system that is run by hand can’t keep up, which creates a bottleneck that makes it harder to grow.

These challenges highlight why optimizing the billing process is crucial for a startup’s survival. How to improve startup cash flow with billing automation is a question that every founder must address. The answer lies in moving beyond manual methods and embracing a more strategic, automated approach.

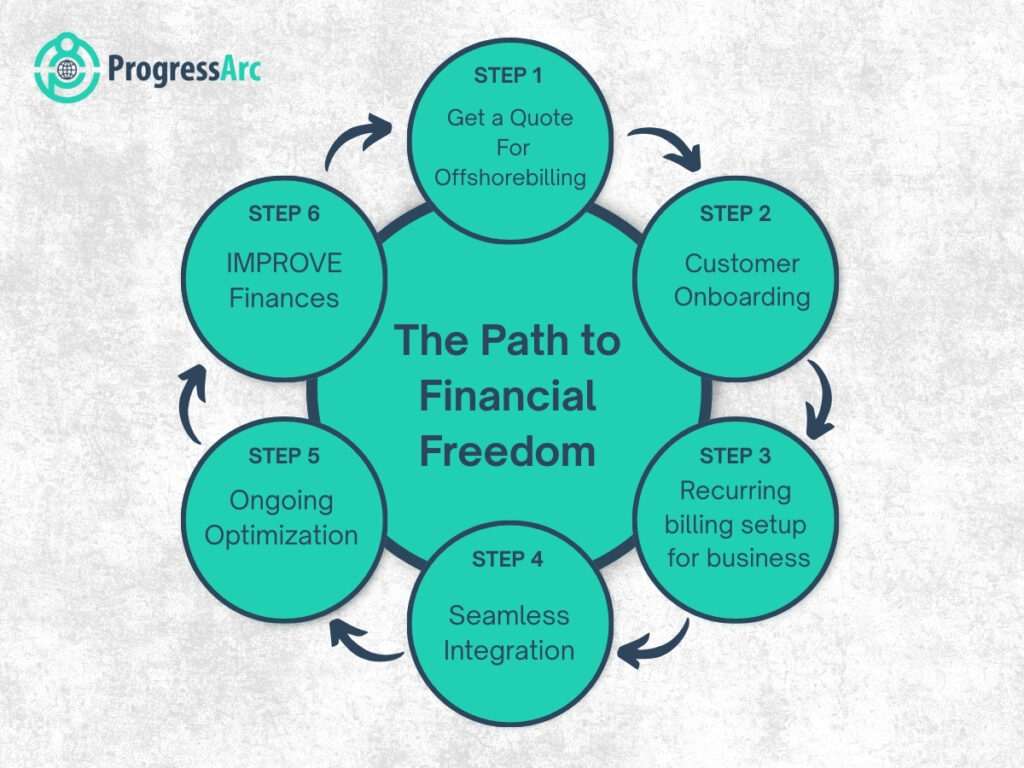

Our Process: A Meticulous Approach to Recurring Billing

At ProgressArc, we know how to optimize cash flow with billing automation. With a systematic and disciplined process, our offshore billing specialists cover every aspect of the billing cycle. Our team uses a methodical approach to ensure accuracy and speed while integrating with your current systems. Here is how we do the recurring billing process for new businesses:

We can further explain offshore recurring billing for entrepreneurs through invoice processing. Our team specializes in outsourced customer billing to reduce errors and improve accuracy.

1. New Customer Billing and Provisioning

Our process begins at the very start of the customer onboarding. We manage the invoicing and provisioning of new customers, which includes two kinds of transactions:

- Active License: The billing subscription is created by our staff using the signed agreement as a guide. After processing the customer’s initial prorated invoice and confirming payment, we create their shop.

- Pre-License: We collect a deposit from clients who are awaiting their license and keep track of their account until they are prepared to proceed.

This careful onboarding is to ensure that all billing information is correct from the start, which prevents future discrepancies.

2. Invoice and Payment Processing

We can further explain,offshore recurring billing for entrepreneurs through invoice processing. Our billing team’s primary responsibility is invoice processing. We create, examine, and transmit invoices using our proficiency with platforms such as ChargeOver. To avoid mistakes, every detail is verified for accuracy.

- Payment Methods: To improve the customer experience, we accept a variety of payment options, such as wire transfers, cash, checks, and offline ACH/e-checks. Customers must submit a payment snapshot as verification for these methods. After confirming receipt of the payment, our finance team applies it to the invoice and provides the customer with a confirmation receipt.

- Payment Statistics: A Payment Method Statistics report is made by our outsourced billing professionals to look at how payments are being made. This is very important for figuring out customer needs and how to make payment methods work better to enhance customer convenience.

3. Proactive Payment and Customer Management

We take a proactive stance to prevent payment issues before they occur.

- Pre-Auto-Pay Review: Before any auto-pay attempt, we carefully review account subscriptions, special notes, and cancellation records to ensure payments are accurate. This minimizes the need for refunds or credits later on.

- Auto-Pay Schedule: Payments are automatically processed on the first working day of each month. For partner invoices, payments are automatically debited on the fifth of each month.

- Expired Payment Methods: We track expired or soon-to-expire payment methods and proactively reach out to customers with a secure link to update their information. This ensures a smooth cash flow and minimizes payment failures.

This ensures a smooth cash flow and minimizes payment failures with the help of our offshore billing support specialists.

4. Handling Failed Transactions and Disputes

When a payment fails, we have a clear, multi-step process to ensure we recover the revenue.

- Failed Auto-Pay: Our remote billing specialists keep a close eye on things to see if an auto-pay transaction is turned down. At first, the system automatically tries to process the payment after a few days. Meanwhile, our billing team continues follow-ups to ensure the payment goes through. To provide extra support, our remote experts also reach out to the customer via call, email, or text to confirm and resolve the issue promptly.

- Disputed Payments: We don’t try to charge the card again for a payment that a consumer later disputes. Rather, we start the required dialogue with the client to settle the issue immediately.

- Write-Offs: If we can’t collect the unpaid balance on a canceled account, we write it off as bad debt to keep our financial reports accurate.

The Transformative Power of ProgressArc Offshore Recurring Billing

Outsourcing your recurring billing to a dedicated offshore team or adopting outsourcing recurring billing USA models is a powerful solution that addresses all these challenges head-on. It’s not just about delegating a task; it’s about gaining a strategic advantage. Here’s how it works:

1. Dramatic Cost Reduction

The most immediate benefit of offshore recurring billing and partnering with the best accounts receivable services providers is a significant reduction in operational costs. By choosing to hire an offshore recurring billing service, startups can access a pool of highly skilled professionals at a fraction of the cost of hiring locally. This cost arbitrage allows you to:

- Slash Payroll Expenses: Eliminate the high salaries, benefits, and recruitment costs associated with a full-time, in-house billing specialist.

- Minimize Overhead: Avoid expenses related to office space, equipment, and administrative support for an internal team.

- Turn Fixed Costs into Variable Costs: Instead of a fixed salary, you pay for the services you need, making your billing function a flexible, scalable expense that grows with your business, not ahead of it.

This shift in cost structure is a game-changer for a startup’s financial agility, freeing up capital to invest in core competencies like engineering, sales, and marketing.

2. Accelerating the Payment Cycle

Faster payments are the lifeblood of a startup. Offshore billing experts are adept at optimizing the entire payment cycle, ensuring you get paid faster and more consistently. They achieve this through:

- Billing Automation: Our remote teams are experts in setting up and managing automated subscription models. They configure leading billing platforms to automatically generate and send invoices on schedule, eliminating delays and ensuring accuracy.

- Proactive Dunning Management: A significant portion of revenue leakage comes from failed payments due to expired credit cards or insufficient funds. Our experts implement sophisticated dunning strategies that automatically send payment reminders, retry failed transactions, and communicate with customers to recover lost revenue. This is a critical component of recurring billing and payment cycle optimization.

- Efficient Follow-up: When manual intervention is required, our teams are dedicated to professional and timely follow-up, ensuring that overdue payments are addressed promptly and respectfully.

3. Enhancing Financial Visibility and Control

With an expert team managing your billing, you gain unparalleled clarity into your financial health. Our remote recurring billing experts provide real-time reports and analytics on key metrics such as:

- Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

- Customer Churn Rate

- Collections Efficiency

- Payment Failure Rates

This data empowers you to make informed, data-driven decisions about pricing strategies, customer retention efforts, and long-term financial planning. This level of insight is invaluable for attracting investors and demonstrating a clear path to profitability.

Conclusion

In the competitive world of startups, every financial decision matters. Offshore recurring billing is a powerful, yet often overlooked, strategy that can fundamentally transform a startup’s financial health. By lowering costs, accelerating payments, and providing expert-driven insights, it enables founders to focus on innovation and growth.

At ProgressArc, we are committed to helping startups achieve this financial freedom. Our remote recurring billing experts USA provide tailored offshore account receivable services, ensuring your billing becomes a source of strength, not complexity Stop letting billing complexities slow you down. Get an offshore billing service quote today and take the first step towards a future of lower costs and faster payments.

FAQ

Q1: What are the benefits of remote recurring billing services for startups?

Remote recurring billing services help startups automate invoicing, reduce payment delays, and ensure consistent cash flow without the cost of maintaining in-house billing teams.

Q2: How do offshore account receivable services improve financial management?

Offshore account receivable services streamline collections, reduce errors, and provide proactive follow-ups with customers. This ensures better cash flow and lower operational costs.

Q3: What’s the difference between annual billing vs recurring billing?

Annual billing charges customers once a year, while recurring billing allows monthly or quarterly payments. Recurring billing offers startups steady cash flow and greater flexibility for customers.

Q4: Why should a U.S.-based startup outsource recurring billing instead of hiring in-house staff?

Outsourcing recurring billing reduces overhead, provides access to specialized expertise, and scales more efficiently compared to managing a full in-house finance team.

Q5: How does ProgressArc support startups with recurring billing services?

ProgressArc provides tailored offshore recurring billing and accounts receivable management services in the USA. Our experts help startups reduce costs, improve accuracy, and focus on growth.