For small businesses and startups, cash flow is vital. If your invoicing is slow, inconsistent, or plagued by manual errors, it can stop that flow, delay payments, and hinder your business’s growth. Many founders and CEOs deal with late invoices and payments or clients who forget to pay or dispute charges. These aren’t just minor issues—they’re critical problems that can slow your business or even put its future at risk.

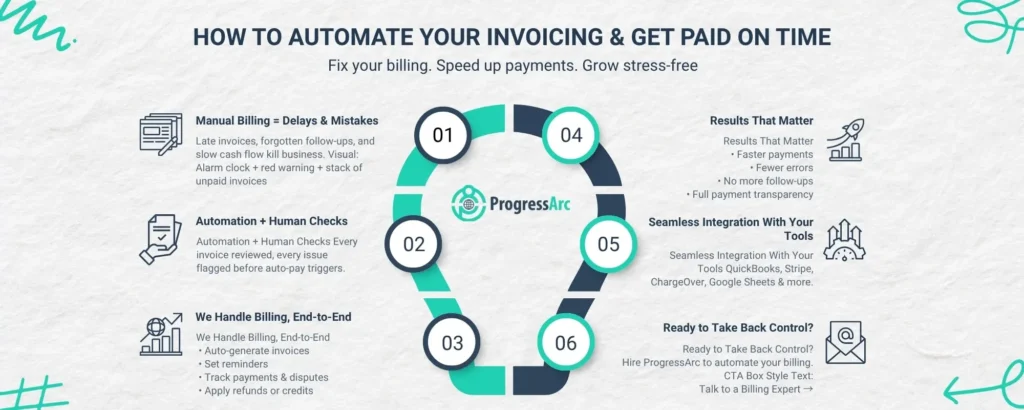

The truth is, automated billing is no longer a luxury. It’s a need for a business with a growing customer base. You can be paid faster by automating billing without interrupting your present workflow if you have the proper technology and the right offshore recurring billing experts in place. That’s precisely what ProgressArc does. Our remote billing consultants for SaaS and B2B work seamlessly with your business, making financial processes easier and turning your back office into a reliable, money-making machine.

Let’s go over exactly how to set up an automated billing system for your small business that runs like clockwork, gets rid of delays, and makes sure you get paid on time.

We work in the background to ensure your cash flow consistently increases, allowing you to focus on developing your product and landing your next big deal.

Why Automated Invoicing Matters More Than Ever

For new businesses, especially those with small staff, making invoices and processing payments often gets pushed to the back. That might work for a time, but as you take on more clients, things become increasingly chaotic. You forgot to send the bills on time. Clients won’t pay unless you follow up. Payments come in slowly, often weeks or even months later.

The good news? You don’t have to change everything about your business. You just need a system with outsourced recurring billing experts that can handle automated billing, and it would be great if ProgressArc could manage it for you.

With automation, invoices are sent out on time, payment reminders are sent automatically, and the payment processing system handles transactions through auto-pay or secure gateways. That means no more guessing, no more chasing, and definitely no more delays.

ProgressArc’s offshore recurring billing experts can help by:

- Generating invoices based on service agreements or subscriptions

- Setting up automated reminders

- Enabling auto-pay using customers’ preferred payment methods

- Verifying failed, pending, and disputed transactions in real time

- Reconciling payments accurately with your accounting system

- Managing exceptions like refunds, credits, or write-offs with complete transparency.

Meet Your Extended Billing Team at ProgressArc

Our billing team at ProgressArc works with accuracy, expertise, and smooth teamwork. Each team member has a specific job to do, so nothing gets missed. We’re more than just a service; we’re your extended offshore billing department.

Here’s how our team works:

- Invoice Specialists manages subscription setups, service tiers, and ensures that invoices are correct and sent on time. He will also verify that invoices align with each client’s contract.

- Payment Collection Experts keep track of unpaid bills and follow up in a professional way. Our remote payment collection expert also ensures that payments are collected consistently.

- Billing Support Representatives, the person is in charge of all inbound and outbound communication, including calls, messages, and emails. The remote billing representative takes care of all client-facing interactions, processing cancellations, and keeping a clear record of every interaction.

- Billing Head: the person is responsible for managing the entire billing process, guaranteeing complete compliance, process optimization and strategic alignment. He works together with the team on billing tasks, handles escalations and reports, and the leadership team provides insight on billing processes.

Each member of our offshore team is experienced in recurring billing. Our offshore remote resources ensure transparency at every step, from keeping records up to date and sharing information to deep insight when necessary. The expert remote resources from ProgressArc work together with your internal teams, attend meetings, and act as a real employee of your business.

How to Automate Invoicing for Small Business Success

Businesses that come to ProgressArc often struggle with a mix of manual processes, late follow-ups, irregular billing, or clients who still prefer to pay with checks rather than digital payments. We need to clean all that out without making you give up your current software. Our remote team utilizes ChargeOver, QuickBooks, Stripe, or custom-built systems to ensure that invoices are accurate, billing preferences are adhered to, and rules are followed.

For instance, our specialists send out client bills on the first of every month (or whenever your client wants), check the terms of the contract, ensure that any modifications to subscriptions are up to date, and read through all of the cancellation letters before sending anything. If we make a mistake, we void the invoice right away and make sure the system explains why. From the beginning, our offshore recurring billing staff makes sure that processing invoices is accurate and professional. Here is the checklist of what we do to automate invoicing

- Generate invoices based on signed contracts.

- Configuring auto-pay using the customer’s preferred payment methods

- Monitoring failed, pending, or disputed transactions in real time.

- Integrating seamlessly with your current accounting system

- Proactive follow-ups via phone calls, emails, or SMS.

- Managing subscriptions, lifecycles (upgrades, downgrades, renewals, and cancellations).

- Processing refunds and issuing credit notes.

- Resolving disputes and coordinating with customer support and success teams.

- Maintaining accurate customer billing records and audit trails.

- Managing payment gateways (Stripe, ChargeOver, QuickBooks, custom platform, etc.)

- Tax compliance & invoice standardization

- CRM, ERP, and helpdesk integration.

- Month-end closing and finance coordination, billing performance, and collections reporting

Streamline Invoice Generation and Collections Without Hiring In-House

One of the hardest things for new businesses to do is hire a full-time recurring billing or finance team. That’s not always cheap, and it might not even be necessary. Most growing businesses need an experienced offshore recurring billing team that can work from wherever, understand your contracts and pricing plan, and handle all of your invoicing needs.

That’s exactly what ProgressArc does. We have remote billing professionals who work with your tools and your team to take care of everything from making invoices to reconciling payments for startups and SaaS enterprises. We help you make invoices and collect payments more quickly so you can focus on making your product or growing your service instead of chasing after money you already have.

Get Paid Faster by Automating Billing the Right Way

A lot of businesses think that automating billing is as easy as clicking a button. The truth is that you need a plan, regular reviews, and consistency. At ProgressArc, we don’t just monitor your system, we automate your invoices for real. Before every payment is made, our professionals check subscriptions, custom billing notes, and the history of the client. This evaluation before auto-pay lowers the risk of mistakes, disagreements, or requests for refunds.

ChargeOver securely processes payments for clients who use auto-pay using credit cards, e-checks, or ACH. Our technology tries the transaction again if it fails, and our team gets in touch with the customer directly by phone, email, or Slack. We even keep an eye on cards that are about to expire and get in touch with clients ahead of time to avert problems.

We also support manual payment options, yes. We make sure that evidence of payment is sent to your finance team and that payments are applied to the right invoice for clients who pay by check, wire, or ACH offline. This all-in-one service makes sure that all sorts of payments are accepted and that every dollar is accounted for.

Best Way to Automate Recurring Invoices for Startups and SaaS Companies

Automation is much more important if your organization depends on recurrent income. We at ProgressArc help startups and service-based enterprises automate their recurring invoicing. We make sure that monthly plans, partner contracts, and custom subscription models are billed correctly, on time, and every time.

We also take care of special cases, such as refunds, credits, or payments that are in dispute. If a consumer pays too much or cancels a service, we give them their money back or give them a credit note, depending on your policy. Everything is captured in real time, and notes are kept on common platforms like Google Sheets or HubSpot so that your leadership team can stay up to date.

If the customer’s bank later disputes a payment, our technology flags it and our team works professionally to fix the problem before trying to charge again. And if collections don’t work after all the follow-ups, we help with write-offs and tracking bad debt so that your reports stay clean and up to date.

How to Integrate Auto-Pay into an Existing Billing System Without Breaking It

One of the most typical things we hear from founders is, “Will this mess up our current system?” No, the answer is no. We actually want to add auto-pay to your current billing system without affecting how you work. We don’t think everything needs to be replaced. We don’t build things from scratch; instead, we improve what you’ve already developed, automate it, and take away the worry.

Using ChargeOver and other tools, our remote staff sets up automatic payments in the way that your client prefers, sends out reminders automatically, keeps track of failed efforts, and makes sure that payment receipts are given out on time. We also teach your team how to run the system in the future, so you can see every transaction, retry, and receipt.

This allows you full control without having to micromanage your billing or create a whole new department to handle collections.

Payment Processing Help for Small Businesses That Want to Grow

The crux of the matter is that your aim isn’t only to send bills; it’s to get paid. That involves having a team and a system that knows how to handle both the technical and personal aspects of billing. You need professionals who can run the procedure and also be careful while dealing with customers.

ProgressArc can help small businesses with payment processing by acting as their extended billing department. We do more than just watch the dashboard. We also deal with missed payments, follow up with clients, keep track of disputes, and even work with your financial team to make manual entries. With us, your payment process becomes a frictionless experience for you and your customers.

Responsive, Human-Focused Customer Care, Every Step of the Way

Even with a fully automated invoicing system and streamlined subscription management, you won’t get on-time payments, correct invoices, or a smooth cash flow just by chance. It’s all thanks to ProgressArc’s billing experts for keeping cash flowing. Automation only works when there is consistent and professional communication. Our remote recurring billing customer service reps are trained professionals who deal with clients’ issues before they turn into complaints, ensuring that the billing process goes smoothly and proactively at every stage.

Our remote experts ensure your clients feel heard, valued, and responded to in a timely manner by walking them through payment options, explaining charges, and following your SOPs for handling cancellation requests. It’s not just about doing business; it’s about trust.

Conclusion: Take Back Control of Your Cash Flow

It’s time to make a change if late payments, invoice mix-ups, and payment disagreements are slowing you down. ProgressArc’s account are the right solution your business truly needs. Your business needs clarity, accuracy, and results. With ProgressArc, you can hire offshore recurring billing experts who connect to your systems, streamline your procedures, and speed up your payments by automating billing.

We’ll help you speed invoice production and collections, set up periodic invoice automation, and carefully and accurately handle every component of the payment processing system, whether you’re running a fast-moving SaaS company or a developing service-based startup.

So, stop chasing payments and start focusing on what really matters: growing your business. ProgressArc is here to make sure you never worry about billing again.